Latest News

Warren Buffett Dumps Apple Stock, Unveils Warning For American Taxpayers As Government Tackles Rising Debt

Published

1 month agoon

Warren Buffett said over the weekend that he expects the U.S. government will increase taxes rather than reduce spending amidst the country’s mounting national debt.

This statement coincides with the U.S. facing significant challenges in addressing expanding fiscal deficits, with the national debt recently surpassing $34 trillion—an amount nearly equivalent to the entire US economy.

🚨🇺🇸BREAKING: WARREN BUFFET CUTS APPLE STAKE BY 13%

— Mario Nawfal (@MarioNawfal) May 4, 2024

Warren Buffet's Berkshire Hathaway has reduced its Apple holdings to about 790 million shares worth $135.4 billion, a 22% decrease in value from last quarter’s $174.3 billion.

Despite the reduction, Apple remains Berkshire's… pic.twitter.com/D1uhKaEYyK

The Daily Mail reported that the Berkshire Hathaway boss highlighted the absence of a visible plan from the Fed and other financial authorities during his declaration on Saturday.

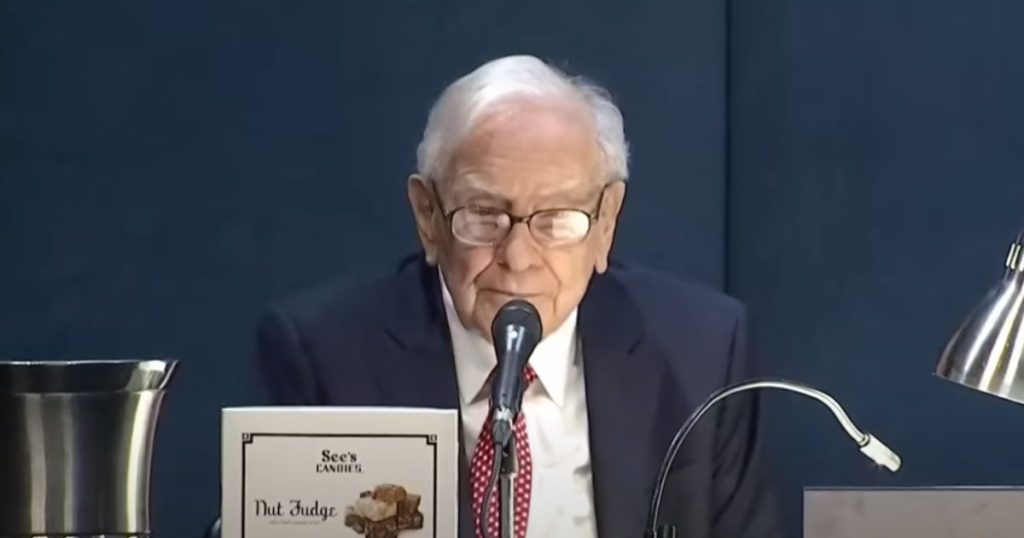

Buffett shared his prediction at the annual shareholder meeting of his revered hedge fund, which attracted some of the country’s top CEOs.

He also noted that these factors prompted Buffett’s Berkshire to reduce its stake in Apple, among several other blue-chip manufacturers, home builders, insurance companies, and retailers within its portfolio.

A move that quickly became a focal point of discussion as the meeting unfolded in real time, with Apple CEO Tim Cook among the high-powered figures present in the room.

Daily Mail outlined that Berkshire’s holding in the iPhone maker dwindled to $135.4 billion at the end of the first quarter, down from the $174.3 billion reported in December.

Warren Buffett Insider Trading Alert 🚨

Berkshire Hathaway dumped roughly $20 billion worth of $AAPL shares in the first quarter, which amounted to roughly 13% of its total Apple position pic.twitter.com/fwAHZZduNa— Barchart (@Barchart) May 5, 2024

Buffett praised the iPhone, however, as one of the greatest products of all time and hinted at tax implications influencing the sale.

Buffett, however, assured the thousands gathered in Nebraska that despite the more than $40 billion sale, Apple remains an “even better” stock than American Express and Coca-Cola, two other “wonderful” businesses in Berkshire’s portfolio.

He emphasized that unless there is a significant change, Apple will retain its position as Berkshire’s largest holding—a glowing endorsement from one of the nation’s most respected financial minds, the outlet notes.

The conglomerate reported during the meeting that its collection of businesses generated approximately $11.2 billion in operating earnings, marking a 39 percent increase from the previous year.

The 93-year-old, whose net worth exceeds $131 billion, remained convinced that a federal tax hike looms on the horizon, saying, “’I think higher taxes are likely.”

“They may decide that some day they don’t want the fiscal deficit to be this large because that has some important consequences,” he added. “So they may not want to decrease spending and they may decide they’ll take a larger percentage of what we own, and we’ll pay it.”

Daily Mail points out that the unprecedented problem arises as U.S. budget deficits are expected to persist if the tax cuts introduced in 2017 are renewed next year.

Everyone is talking about Berkshire Hathaway’a reduction in Apple.

— David (TalkingCents) (@talkcentss) May 4, 2024

But the real message is clear,

Warren Buffet is telling you that the capital gains tax is going to rise.

US Fiscal deficits are a concern.

“My best speculation is that U.S. debt will be acceptable for a very long time because there’s not much alternative,’ Buffett said, highlighting that the U.S. dollar is the world’s foremost reserve currency.

Buffett added that while the current focus may be on the Fed’s next steps to address inflation through a series of interest rate hikes, the impending fiscal policies of the bank could pose the real issue.

“Jay Powell is … a very, very wise man,” Buffett said of the central bank’s top official. “But he doesn’t control fiscal policy.”

Scroll down to leave a comment and share your thoughts.